Well, I’m going back to www.litecoinpool.org from www.prohashing.com …prohashing has decided in 2018 if you make more than $600 usd you have to fill out a 1099 form to the IRS.

Now I’m legal, but what happened when coinbase got all up on such forms, the IRS went after them, so I find it easy to see the IRS going after a popular pool that has done this. Even if I am legal, I don’t need the IRS to play 'fishing expidition" and send out blanket ‘show the source of your funds letters in mass’ to all on prohashing.

I prefer the IRS to audit me the old fashioned way, like a normal tax paying business, not single me out thru a site that does evil crypto mining

I only mined to LTC anyway (though mining Verge now in case I hit $600 and am cut off before I get the data hall to make the change)

I went thru this ‘show the source of your funds’ letter with the SEC in the usa…it is a pain

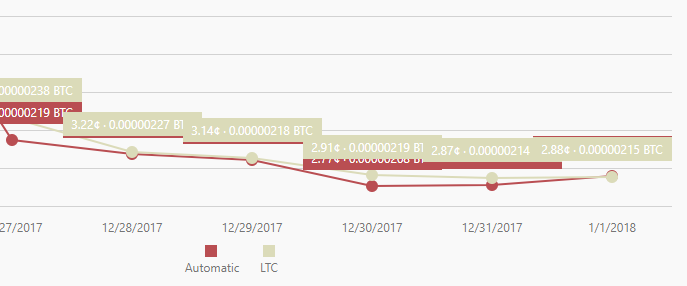

So anyway, I mine to LTC direct anyway…so back to www.litecoinpoool.com which has been equiv in hashing since bitconnect coin went pos coin and left prohashing anyway

and litecoin is soooooo stable I ran it for 2 years plus up to july 2017 w/o a back up pool on the titans

anyway, I am not an employee of prohashing…if the IRS wants to track me they can audit me direct and just look at the same damn litcoin address I’ve used the last 3 years and 2 months to track stuff

I’m not gonna be part of a pool that DANGLES easy fishing to the IRS with 1099’s they don’t really have to issue…and have a lawyer who knows crap about mining…

So I’m out, as to the rest staying on Prohashing good luck…and to those outside of usa …remember coinbase where IRS went after everyone in and out of usa…if they do the same with PH, remeber the old know your customer rules among nations…you too could get a show us your funds letter from your respective governments anyway …iimho

the irs went after coinbase for ALL info from ALL customers (15 million) including passwords…because they found 3 people using coinbase to hide taxes cash via crypto

yeah, good luck prohashing, I expect half your folk are gonna walk to other sites and you still are gonna

have to deal with IRS and other countries requesting know your customer rules…your lawyer is dumb on crypto but brillant on getting lots of your $$$ when that comes home to roost!

anyway, again I’m legal used the same LTC address for mining for 3 years and 2 months …they can

audit me directly and follow that (the iRS) so no way am I doing a 1099 for the PH clowns…

(good thing I did not go on a rant .that would have been ugly)

anyway, always liked litecoinpool, if I lose 10% mining and don’t have to fill out a 1099 so be it

brad